Financial results 4Q23 and 2023 الحالة

-

Who we are

-

What we do

رجوع

What we do

access-the-page What we do

access-the-page Where are we

رجوع

Where are we

access-the-page Brazil

-

Our people

رجوع

Our people

access-the-page Our people

access-the-page Proud to be Vale

رجوع

access-the-page Opportunities for professionals

رجوع

access-the-page Opportunities for students

-

Investors

رجوع

-

Suppliers

رجوع

Suppliers

access-the-page Suppliers

access-the-page I'm a Supplier

رجوع

-

Our Future

رجوع

Our Future

access-the-page Our Future

access-the-page Sustainability

رجوع

access-the-page Innovation

access-the-page Patrocínios

رجوع

-

Reparation

recent-searches

روابط سريعة

- Home

- Who we are

- What we do

- Projeto Bacaba

- Mining

- Dam Elimination

- Energy

- Logistics

- Canada

- Voisey's Bay

- Port Colborne

- St. John's

- Thompson

- Toronto

- Sudbury

- Careers in Canada

- Long Harbour

- Safety Data Sheets

- Products

- Greater Sudbury Air Quality

- Oman

- Japan

- Brazil

- United Kingdom

- Malaysia

- China

- Pará

- Espírito Santo

- Maranhão

- Minas Gerais

- Rio de Janeiro

- Programa de Descaracterização

- Itabira

- A Vale em Nova Lima

- Itabira

- A Vale em Barão de Cocais, São Gonçalo do Rio Abaixo, Santa Bárbara e Rio Piracicaba (MG)

- A Vale em Ouro Preto, Catas Altas e Mariana (MG)

- Our people

- Proud to be Vale

- Global opportunities

- Opportunities for students

- Opportunities for professionals

- Diversity

- Vale’s Health Insurance Scheme

- Investors

- Check out our company

- Corporate Governance

- Information to the market

- Announcements, Results, Presentations and Reports

- Dividends, Debts and Debentures

- Contacts

- Relatório Financeiro 4T23

- Suppliers

- I'm a Supplier

- Payment status

- Requesting pickups

- Schedule deliveries

- Mobilization and Demobilization (ERRO)

- How to measure

- Registration of suppliers

- Receiving and returning quotes and orders

- Treatment of discrepancies in orders and tax invoices

- How to send invoice

- Mais Capital Vale

- Mobilization and Demobilization

- Be a supplier

- Partilhar Program

- Our Future

- Reparation

- Obras

- Indemnity

- Environment

- Social

- Economy

- Adoção de animais antigo

- Monitoring Plan for Emergency Works

- Dashboard Waste Management

- adoção-testes

- Animal Adoption

- Obras

- Vale now

- All News

- Transform Together

- Vale will start tests to implement autonomous operation in off-road trucks in Carajás

- 50 years of partnership between Vale and China

- Programa de Aceleração de Mulheres Negras

- Snolab

- Reserva Natural Vale divulga programação para novembro

- 2022 Extraordinary Meeting of Shareholders

- Instituto Cultural Vale celebra Maria Firmina dos Reis e leva o Maranhão à 20ª FLIP

- At a UN event, Malu Paiva highlights projects supported by the Vale Foundation to generate income for women in high social vulnerability

- Vale: for 80 years transforming the future

- Vale 80 years: discover stories of those who help us write ours

- 80 anos Vale: como chegamos até você

- Plano Diretor Ambiental de Tubarão

- Reserva Natural Vale divulga programação para dezembro

- Vale Day 2022 in New York

- 80 anos Vale: para além da mineração

- Dia Internacional Contra a Corrupção: nossos executivos lembram a importância do tema

- Projeto das novas pontes sobre o Rio Tocantins, em Marabá (PA), contribui para desenvolvimento socioeconômico da região

- Programa Valorizar premia organizações sociais de Barão de Cocais e Santa Bárbara

- Conheça a cultura do Pará na websérie “Papo de Raiz”

- Vale to hold event at United Nations Water Conference

- Reserva Natural Vale divulga programação para janeiro

- 4Q22 Sales and Production report

- Reserva Natural Vale divulga programação para fevereiro

- Energia para transformar o futuro: assista aos novos episódios de “Juntos para Transformar” no YouTube

- Check out the 4Q22 Financial Results

- Women who transform science and inspire new professionals

- PT Vale and PT BNSI Inaugurate the Construction of the Integrated Low Carbon Nickel Mining and Processing Project in Morowali

- Viva Engage Vale

- Museu Vale apresenta exposição sobre Leonardo Da Vinci

- Annual and Extraordinary Meetings of Shareholders

- Alteração nas alíquotas de ICMS

- Confira as operações no Maranhão que voltarão a ser tributadas pelo ICMS a partir de 1º de abril

- A nova edição do Balanço Vale+ já está disponível!

- 1Q23 Sales and Production report

- Check out the 1Q23 financial report

- Programa Valorizar premia instituições em 8 municípios

- Nova sede da Escola Municipal Meridional será entregue no começo do segundo semestre

- TRSP Requirements and Application Form

- TCA Praia de Camburi

- Chamada Instituto Cultural Vale

- 1º Edital Uso Futuro MAC

- Programa de Descaracterização de barragens a montante avança

- Obras de descaracterização começam em mais uma estrutura a montante da Vale: o Dique 1A

- Participe da etapa de Capacitação do Programa Valorizar – Caeté (MG)

- Reorganização de Metais Básicos no Brasil: fornecedores devem ficar atentos aos novos CNPJs

- Circuito Corrida Vale 2024 – Juntos para transformar

- 2Q23 Sales and Production report

- Conselheiro Lafaiete recebe novo prédio da Escola Municipal Meridional

- Check out the 2Q23 Financials Results

- Festivais de Inverno em Minas Gerais

- Reorganização de Metais Básicos no Brasil: Confira o procedimento para Retorno de Conserto de Materiais enviados no CNPJ Vale anterior

- Vale promove nova edição do Programa de Preparação para o Mercado de Trabalho

- Prêmio Valor Inovação 2023 elege a Vale como a mais inovadora do setor de Mineração

- Bienal das Amazônias reunirá mais de 120 artistas

- Festival Vale Amazônia

- Fluxos para solicitação de reanálise de indenizações por danos à saúde mental em Brumadinho

- Projeto MAC Uso Futuro

- Balanço Vale+: Edição 1º Semestre de 2023

- Programa de Preparação para o Mercado de Trabalho chega em Ourilândia do Norte e Região

- Indonesia Sustainability Forum 2023

- Vale abre inscrições para o Programa de Preparação para o Mercado de Trabalho (PPMT) em Canaã dos Carajás

- Check the 3Q23 performance report dates

- Iron Ore Briquettes

- The 3Q23 sales and production report

- Resultados de vendas e produção 3t23

- Check out the 3Q23 Financials Results

- Amazon

- Resultados do Edital Uso Futuro

- Vale Day 2023 London, UK

- Vale Day 2023 London, UK 2

- Vale Day 2023 London, UK 3

- 4Q23 sales and production report

- Check out the 4Q23 performance report dates

- Reserva Natural Vale divulga programação para Fevereiro

- Movimentações em janeiro: saiba quais foram as mudanças no nosso time no início de 2024

- Check out the 4Q23 Financials Results

- 2024 Annual and Extraordinary Shareholders' Meetings

- Projeto Apolo

- Simulado de Segurança de Barragens - Itabira Eixo Norte

- Vale patrocina a Festa da Penha e encanta fiéis com ações especiais

- 1Q24 Production and Sales report

- Programa para pessoas recém-formadas em Engenharia

- Check out the 1Q24 performance report dates

- Check out the 1Q24 Financials Results

- Simulado de Segurança de barragens da mina de Águas Claras, em Nova Lima

- Programa Valorizar 2024: Barão de Cocais e Santa Bárbara

- Inscreva-se para o processo seletivo do Programa de Preparação para o Mercado de Trabalho

- Juntos pelo Rio Grande do Sul

- Discover your realm of possibilities

- See the mining in your life

- Descaracterização da barragem B3/B4

- Atenção fornecedor: aprenda a identificar quando um e-mail em nome da Vale é verdadeiro

- We are committed to building a better Manjung through impactful social investments

- Reserva Natural Vale divulga programação para julho de 2024

- Nova estrutura da contenção a jusante no Sistema Pontal

- 2Q24 Vale’s Performance

- 2Q24 performance report dates

- Check out the 2Q24 Financials Result

- Mais segurança: Barragem Sul Superior deixa nível máximo de emergência

- 2024 Extraordinary Shareholders’ Meeting

- Estágio de Nível Superior para Metais Básicos - Exclusivo Pará

- Confira a programação de agosto do Parque Botânico São Luís

- Reserva Natural Vale divulga programação para agosto

- Vale é destaque em eficiência energética em podcast do MIT Technology Review

- Vale ganha o primeiro lugar do Prêmio Valor Inovação 2024 como a mais inovadora do setor de Mineração, Metalurgia e Siderurgia

- Vale abre inscrições para o Programa de Preparação para o Mercado de Trabalho (PPMT) em Canaã dos Carajás

- Participe da Corrida e Caminhada Metais Básicos

- Confira a programação de setembro do Parque Botânico São Luís

- Parque Costeiro

- Inscreva-se para o processo seletivo do Programa de Preparação para o Mercado de Trabalho em Mangaratiba, Rio de Janeiro

- 3

- Confira a programação de outubro do Parque Botânico Vale

- Confira a programação de outubro do Parque Botânico Vale

- 3Q24 performance report dates

- Parceria + Segura: Vale promove Evento de Premiação e Reconhecimento de Fornecedores

- Vale abre 20 vagas na área de Tecnologia e Inovação em três estados do Brasil

- Check out the Production and Sales results for 3Q24

- Check out the 3Q24 Financial Results

- Confira a programação de novembro do Parque Costeiro

- Vale day 2024

- Confira a programação de dezembro do Parque Botânico Vale

- Confira a programação de dezembro do Parque Costeiro

- Confira a programação de janeiro do Parque Botânico Vale

- Confira a programação de janeiro do Parque Costeiro

- 4Q24 performance report dates

- Check out the 4Q24 Financial Results

- Check out the Production and Sales results for 4Q24

- Confira a programação de fevereiro do Parque Botânico Vale

- Confira a programação de fevereiro do Parque Costeiro

- Reserva Natural Vale divulga programação de março

- Vale announces R$70 billion investment in New Carajás Program in Pará by 2030 at ceremony with President Lula

- Programa Qualificar

- Confira a programação de março do Parque Botânico Vale

- Confira a programação de março do Parque Botânico Vale

- Confira a programação de março do Parque Costeiro

- Contribute to the public consultation on Vale's Climate Change Policy

- 2025 Annual and Extraordinary General Meetings

- Circuito Corrida Vale 2025: inscrição gratuita com mais vagas e novas experiências

- 1Q25 performance report dates

- Teste EN

- Check out the Production and Sales results for 1Q25

- Press Releases

- Our stories

- Travel with us

- Vale Botanical Parks and Spaces

- Fazenda Marinha Project

- Vale Botanic Park in São Luís

- Vale Natural Reserve

- Biopark Vale Amazônia

- Vale Botanical Park Vitória

- Passenger train

- History Center

- Transparency

- Document library

- Speak with Valebackup

- Whistleblower Channel

- Privacy at Vale

- Aviso externo de privacidade

- Aviso externo de privacidade Japan

- Aviso externo de privacidade Malasia

- Aviso externo de privacidade Europa

- Aviso externo de privacidade China

- Aviso externo de privacidade Oman

- Aviso externo de privacidade Singapore

- Push notifications

- Code of Conduct

- formssucesso

- Speak with Vale

- Under construction

- link teste

- investidoresbk

- Commitment to combating poverty

- Search center

- Accessibility

- Admin

- Indonesia

- About PT Vale

- Our history in Indonesia

- Indonesia Growth Projects

- Our Organization

- All News

- Awards and Certifications

- Sejarah kami di Indonesia

- About PT Vale Indonesia

- Governance

- Investors

- Major and Controlling Shareholders

- Annual and Sustainability Reports

- Financial Statements

- Financial Highlights

- General Meeting of Shareholders

- Shares Information

- Dividend

- Capital Market Supporting Institutions and/or Professionals

- Press Releases

- Prospektus

- Prospektus

- Sustainability

- Environment

- Emission

- Biodiversity

- Post Mining Rehabilitation

- Waste

- Water and Effluent Management

- Sawerigading Wallacea Biodiversity Park

- Social

- Our People

- Practical Work and Student Research

- Co-Ops Program

- Community

- Human Rights

- Social Development Program

- Occupational Health and Safety

- Covid-19

- Diversity, Equity, Inclusion

- East Luwu Community Scholarship

- Sustainabillity Report 2022

- Sustainability Report

- SR Backup

- Transparency and Policies

- Careers

- ESG

- ESG Governance

- ESG Strategy

- ESG Risk Management

- ESG Risk Assesment

- ESG Roadmaps

- ESG Flagship Programs

- Dongi Resettlement

- Organic SRI Rice

- Scholarship Anak Asuh

- Promoting Health and Preventing Sickness

- Female Hiring and Female in Leadership

- Unwavering Commitment in Ensuring Adequate Working Conditions

- Labor Union

- Local Talent Development Program

- Utilization of Used Oil as Fuel in Dryers and Reduction Kilns

- Clean Water Initiative

- Operation of Electric Boilers to eliminate MFO

- Progressive Reclamation to Transform the Post-Mined Lands

- Hydropower Plant Supply Alternative Route Program for Auxiliary Grid (ROJALI)

- Wellness Wonders: Energizing Health and Safety Pursuits in Local Communities

- Wellness Program

- Integrating Safety in Every Operation of Our Company

- ESG Target

- ESG Performance and Updates

- ESG Ratings and Awards

- Shareholder information

- Opportunities in Indonesia

- Vale News Archive

- Vale Release Archive

- Base Metals

- ESG

- Our Approach

- Sustainable mining

- Dams

- Nature

- Waste management

- Circular mining

- Mine closure and Future Use

- Water and effluents

- Biodiversity

- Air emissions (non-GHG)

- Environmental compliance

- Climate

- Social

- Reparation

- Controversies

- Document Library

- Last updates

- testeesg

- Redirecionamentos ESG

- Teste filtros

- Aviso externo de privacidade Malasia bahasa

- Vale day

•

Financial results 4Q23 and 2023

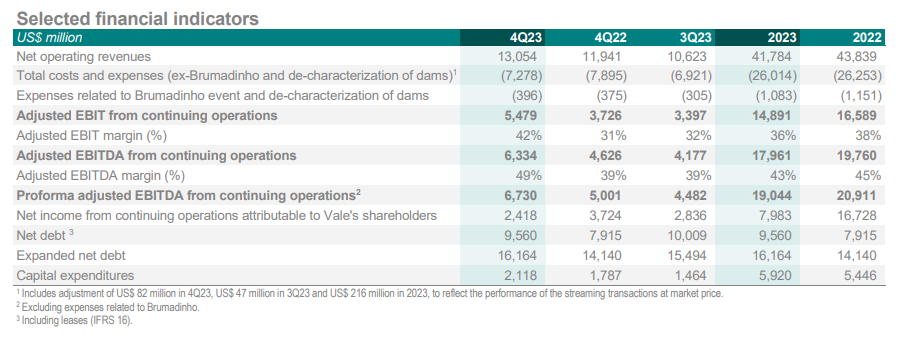

"2023 was a remarkable year for Vale. Our results translated the evolution of our safety-driven cultural transformation and our progress towards operational excellence. Regarding our Safety Journey, in 2023 we recorded the lowest injury frequency rate in our history. Our 2023 iron ore production at 321 Mt exceeded our guidance and provided evidence of increased asset and process reliability. In addition, we started up our 1st briquette plant and entered into a partnership with Anglo American in a world-class operation, important steps to support our strategy to grow with quality. In our path to transform the Energy Transition Metals business, copper production had an impressive 50% growth in the 4th quarter, while nickel production was in line with guidance. Regarding our commitments, 2023 saw a substantial progress in the reparations of Brumadinho and Mariana. Finally, we remain focused on a disciplined capital allocation, consistently returning value to our shareholders, as evidenced by our recent dividend announcement. We have walked the talk, and I am excited that Vale is progressing towards achieving even greater performance levels”, commented Eduardo Bartolomeo, Chief Executive Officer.

Highlights

Business Results

• Proforma adjusted EBITDA from continued operations of US$ 6.7 billion in Q4, up 35% y/y and 50% q/q on the back of better operational performance and strong iron ore prices. Proforma adjusted EBITDA from continued operations of US$ 19.0 billion in 2023, down 9% mainly due to lower average iron ore, copper, and nickel reference prices in the year.

• Iron ore fines C1 cash cost ex-3rd party purchase decreased 5% q/q, reaching US$ 20.8/t in Q4. In 2023, it reached US$ 22.3/t, below the US$ 22.5/t guidance for the year.

• Free Cash Flow from Operations of US$ 2.5 billion in Q4, representing an EBITDA to cash-conversion of 37%.

Disciplined capital allocation

• Capital expenditures of US$ 2.1 billion in Q4, an increase of US$ 331 million y/y, resulting primarily from increased investments in Iron Ore Solutions projects, particularly Capanema and the Carajás Railway, and higher investments to enhance our Energy Transition Metals mining operations.

• Gross debt and leases of US$ 13.9 billion as of December 31st, 2023, US$ 113 million lower q/q.

• Expanded net debt of US$ 16.2 billion as of December 31st, 2023, US$ 670 million higher q/q, mainly driven by the US$ 1.2 billion provision increase related to the Renova Foundation and a potential global agreement framework. Vale´s expanded net debt target continues to be US$ 10-20 billion.

Value creation and distribution

• US$ 2.4 billion in dividends to be paid in March 2024, considering Vale’s ordinary dividend policy applied to 2H23 results.

• US$ 2.0 billion in dividends and interest on capital paid in December 2023, referring to the anticipated allocation of the 2023 results.

• Allocation of US$ 44 million as part of the 4th buyback program in the quarter. As of the date of this report, the 4th buyback program was 15% complete , with 22.6 million shares repurchased.

Recent developments

• Agreement signed with Anglo American, in February, to acquire a 15% ownership interest and establish a partnership encompassing the Minas-Rio iron ore complex and Vale’s Serra da Serpentina resources in Brazil. Following completion of the transaction, Vale will receive its pro-rata share of Minas-Rio production. Minas-Rio has an estimated high-grade pellet feed production capacity of 26.5 Mtpy.

• MoU signed with Hydnum Steel, in February, to jointly evaluate the feasibility of building an iron ore briquette plant in Hydnum Steel's flagship project for green steel in Puertollano, Spain. The plant will begin producing 1.5 Mtpy of rolled steel in 2026, and it is projected to have a 2.6 Mtpy capacity starting from 2030.

Click here for full report and Management Report 2023

Media Relations Office - Vale

imprensa@vale.com

See also

Reparation

Vale

Iniciativas

Anda mengakses pengalaman:

IP Address: 18.216.179.164

Iniciativas